Business Problem

A leading pharmaceutical manufacturer based in New Jersey struggled with an outdated, manual return processing system. The company used Excel for data management, which led to inefficiencies and compliance risks in handling returns from third-party distribution vendors.

The key challenges included:

- Time-consuming pricing and expiry validations done manually

- Error-prone calculations using outdated Excel templates

- Inconsistent compliance and audit tracking

- Delayed credit memo generation due to lack of real-time ERP integration

- Limited scalability for expanding similar workflows (e.g., rebates, chargebacks)

This manual approach consumed valuable resources and created significant risks, including regulatory non-compliance and financial reconciliation inaccuracies.

Business Solution

Pronix Inc. implemented a low-code automation solution leveraging Microsoft Power Platform, SAP S/4HANA, and Azure Active Directory to streamline the entire return lifecycle, from file intake to ERP posting and credit memo creation.

Key capabilities included:

- Automated File Ingestion: From SFTP to SharePoint/OneDrive with real-time triggers

- Smart Data Transformation: Using Excel and Power Automate for pricing updates and return classification

- ERP Integration: Seamless validation and transaction automation through SAP (ZSD036, VF04)

- Error Handling & Audit Logging: Secure and compliant access via Azure AD

This solution eliminated bottlenecks, optimized resource usage, and ensured a scalable process that could extend to other financial operations such as rebates and chargebacks.

Technical Solution

The return processing solution was built using the following Microsoft and SAP tools:

- Microsoft Power Automate: Automated workflow orchestration and embedded Excel logic for return classifications

- Microsoft Excel: For pricing calculation and return reason code assignment

- SAP S/4HANA: Automated file submission and credit memo generation using APIs and UI automation

-

Azure Active Directory: Role-based access control ensuring secure governance and compliance

Technologies Used

Customer Success Outcomes

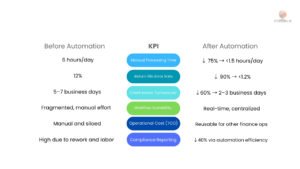

- Reduced Processing Time: Manual processing time reduced by 75%, going from ~6 hours/day to <1.5 hours/day.

- Lower Error Rate: The return file error rate decreased by 90%, from 12% to <1.2%.

- Faster Credit Memo Generation: Credit memo turnaround time reduced by 60%, from 5–7 business days to 2–3 business days.

- Real-Time Compliance Reporting: Centralized and automated compliance reporting ensured real-time visibility, replacing fragmented manual efforts.

-

Cost Reduction: Operational costs decreased by 40%, as automation eliminated rework and reduced labor requirements.

Strategic Value Delivered

- Scalable Automation: The solution created reusable automation patterns, laying the groundwork for automating other finance operations like rebates and chargebacks.

- Enhanced Compliance & Audit Trail: The solution ensured real-time, compliance-ready reporting and secure access control through Azure AD.

-

Operational Efficiency: The company gained significant operational efficiency, freeing up resources for more strategic, high-value tasks across the business.